Fin-X Weekly Update 25th November 2024

- Brett Careedy

- Nov 25, 2024

- 7 min read

Stock markets headed back towards record highs last week, and yields were steady ahead of significant inflation updates this week. The US will see lighter trading this week due to the Thanksgiving holiday.

Nvidia announced record results but traded sideways as analysts had mixed interpretations of the outlook.

The RBA minutes revealed some uncertainty surrounding its inflation forecasts.

US PMIs revealed post-election optimism, while other surveys were subdued.

The change in government and the SEC chairman’s resignation also likely signals a coming of age for cryptocurrencies.

In global politics, the G20 and COP29 wrapped up with scant progress on climate.

Equity markets rose last week, trading close to the recent record highs.

Stock investors focussed on the results of A.I. darling Nvidia, which saw the company report revenues that were up +94% on the same quarter a year ago, beating all but the most optimistic estimates. According to Bloomberg, CEO Jensen Huang said that Nvidia’s highly anticipated Blackwell products will ship amid “very strong” demand this quarter. However, the production and engineering costs of the chips will weigh on profit margins. Some analysts were also concerned that the guidance suggested that the revenue growth trajectory might be slowing, although the company may just be providing conservative estimates. The stock price was unchanged over the week, having already risen +187% this year in US dollar terms.

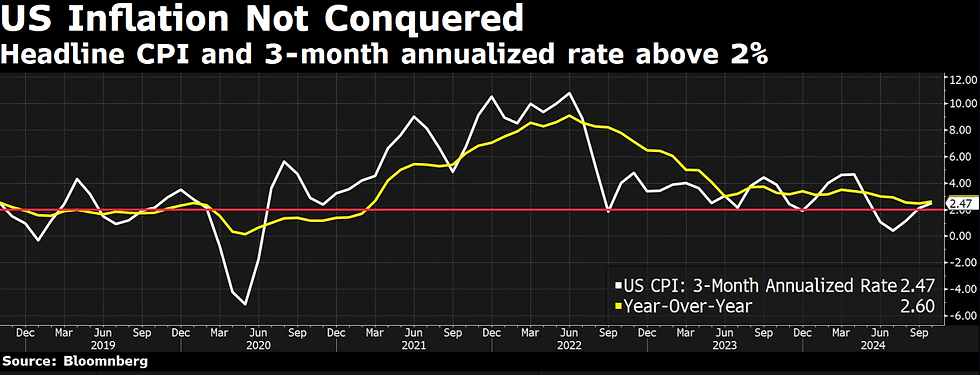

Bond yields were generally steady ahead of important inflation data this week. Japanese short-dated bond yields saw a little more upward pressure after a slightly firmer-than-expected core Japanese inflation print ex-food and energy (+2.3% yoy). The headline rate slowed to +2.3 yoy, as anticipated.

On Wednesday, American PCE inflation is also expected to accelerate from an annual increase of +2.1% to +2.3% and core PCE from +2.7% to +2.8%.

Also on Wednesday, the ABS’ monthly Australian CPI estimate is expected to accelerate from +2.1% yoy to +2.3% yoy.

The RBA November minutes indicated a high degree of uncertainty surrounding the inflation forecasts in the recent quarterly Statement on Monetary Policy. The market pricing of the first rate cut has now been pushed back to May next year. However, the S&P Global Australian flash PMI report said, “Business activity in Australia’s private sector declined midway through the final quarter of 2024 as services activity joined manufacturing output in contraction. The reduction in activity coincided with a slowdown in new business growth while external demand remained subdued. Australian firms therefore raised staffing levels at only a marginal pace as spare capacity remained evident. Despite the softening of conditions, sentiment improved as confidence reached a 15-month high in November.”

In American data, the latest Quarterly Census of Employment and Wages showed that employment grew by just +0.8% in the year ending June 2024, or at roughly half the rate implied by the non-farm payroll reports. The figures provide some upside risk to unemployment when the headline numbers are eventually adjusted next year. However, the data may be superseded by the evolution of conditions after the change in government.

European PMIs showed a deterioration in services that matched the weak manufacturing readings. However, the US flash PMI stood out among peers as the uplift in service responses matched the recent surprise in the ISM Services survey. Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said, “The business mood has brightened in November, with confidence about the year ahead hitting a two-and-a-half year high. The prospect of lower interest rates and a more pro-business approach from the incoming administration has fueled greater optimism, in turn helping drive output and order book inflows higher in November. The rise in the headline flash PMI indicates that economic growth is accelerating in the fourth quarter, while at the same time inflationary pressures are cooling […] A concern is that growth remains heavily reliant on the services economy, with manufacturing production declining at an increased rate. However, the promise of greater protectionism and tariffs has helped lift confidence in the US good producing sector, which is already feeding through to higher factory employment. Factories are meanwhile stepping up their purchases of imported inputs as they seek to front-run tariffs, putting pressure on supply chains to a degree not seen for over two years. Any further stretching of these supply lines could see prices move higher as demand outstrips supply”.

Investors continued to process the list of TV hosts and Project 2025 authors put forward for positions in the incoming Trump administration.

The Biden-appointed chair of the Securities and Exchange Commission, Gary Gensler, announced last week that he would leave his position on January 20th next year rather than wait to be sacked as the president-elect has promised.

Before taking over the SEC in 2021, Mr Gensler had worked at Goldman Sachs for 18 years, served 5 years as head of the Commodity Futures Trading Commission, and taught a course that covered the blockchain and money in his role as professor of Practice of Global Economics and Management at the MIT Sloan School of Management. Despite saying that he is not against cryptocurrencies, he has also described the industry as the “wild west", overseeing several enforcement actions and attempting to obstruct the Grayscale bitcoin exchange-traded products (ETPs) launch. The decision was overturned on appeal in January, paving the way for several new ETPs. Several bitcoin ETPs have now been launched in Australia, and cryptocurrencies seem likely to become more mainstream in wealth management. From now on, this report will include the value and performance of bitcoin in Australian dollars on the front page each week.

At the G20 meeting in Rio De Janeiro last week, the joint Declaration centred on three themes related to the international economic and political situation, social inclusion and the reduction of poverty, and sustainable development and the energy transition.

The communique fell short of condemning Russian aggression as had previously been included. But the meeting coincided with the decision by NATO powers to allow longer-range missiles to be launched into Russian territory by Ukraine. The Kremlin responded to the perceived escalation by firing a new ballistic missile that is capable of delivering nuclear payloads.

The statement also lamented that “progress towards only 17% of the SDG targets is on track, nearly half are showing minimal or moderate progress, and progress on over one-third has stalled or even regressed”.

Taking place simultaneously in Baku, the UN Climate Change Conference (COP29) closed with “a new finance goal to help countries to protect their people and economies against climate disasters and share in the vast benefits of the clean energy boom”.

The agreement will:

“Triple public finance to developing countries, from the previous goal of USD 100 billion annually, to USD 300 billion annually by 2035.

“Secure efforts of all actors to work together to scale up finance to developing countries, from public and private sources, to the amount of USD 1.3 trillion per year by 2035.”

Countries also agreed on how carbon markets will operate under the Paris Agreement, making country-to-country trading and a carbon crediting mechanism fully operational.

The US will see lighter trading this week due to the Thanksgiving holidays. The European IFO surveys and the FOMC minutes will be released, as well as the inflation updates.

Significant Upcoming Data:

| Monday | Tuesday | Wednesday | Thursday | Friday |

Australia |

|

| CPI; Construction Work Done | Private Capex | Private Sector Credit |

US | Chicago Fed. National Activity; Dallas Fed. Manuf. Activity

| FOMC Minutes; Conf. Board Cons. Conf.; S&P CoreLogic & FHFA House Prices; New Home Sales; Rich. Fed. Manuf. Index & Bus. Cond. Dallas Fed. Serv. Activity

| PCE Inflation; Personal Inc. & Spending; Durable Goods Orders; Adv. Goods Trade; WSale & Ret. Inventories; Pending Home Sales; Q3 GDP (2nd Est.); MBA Mortgage Apps; Weekly Jobless Claims

| Thanksgiving |

|

Europe | IFO Survey; Spanish & Finnish CPI; Norwegian Credit Ind. Growth; Irish Cons. Conf.

| Swedish PPI; Belgian Bus. Conf.; UK CBI Trends & BRC Shop Price Index; Finnish Unempl. | German GfK & French Cons. Conf.; Swiss UBS Survey; Unicredit Bank Austria Manuf. PMI; [German Ret. Sales]; Swedish Household Lending; Norwegian Unempl. Trend; Finnish Bus. & Cons. Conf.

| EZ M3 Money Supply; EZ Cons., Serv., Indus. & Econ Conf.; Italian Cons., Manuf. & Econ. Conf.; German, Spanish & Danish Ret. Sales; Spanish CPI & Mortgage Apps.; Italian & Irish PPI; Irish Ret. Sales & CPI; Dutch Prod. Conf.; Swedish & Finnish Trade; Swedish Econ. Tendency Survey, Cons. Conf. & Manuf. Conf.; Finnish House Prices

| EZ, German, French, Italian & Dutch CPI; ECB 1yr & 3yr CPI Exp.; UK M4 Money Supply; German & Danish Unempl.; Swedish & Finnish Q3 GDP & Ret. Sales; Swiss Q3 GDP & KOF Leading Indic.; Norwegian Unempl. & Ret. Sales; French PPI, Cons, Spending & Total Payrolls; Austrian CPI & PPI; Italian Ind. Sales; Spanish Curr. Acc.; Swedish Non-Manual Wages; UK Lloyds Bus. Barometer & Price Exp.; Finnish GDP & Ret. Sales; French & Belgian Q3 GDP (Final)

|

Japan | Leading & Coinc. Index; Dept. Store Sales

| PPI |

|

| Jobless Rate; Job-to-Appl. Ratio; Retail Sales; Ind. Prod.; Housing Starts; Cons. Conf.; Tokyo CPI

|

China | [1yr Med. Term Lending Rate]

|

|

|

|

|

Disclaimer

The contents of this communication is prepared by Brerona Capital Asset Management Pty Ltd (A.C.N. 627 650 293; AFSL 520526). The information contained in this communication is general in nature and does not take into consideration any investors personal objectives, goals, needs and financial situation. You should not rely on the information contained in this document to make any investment decisions without first consulting an investment professional such as your financial adviser. Any unauthorised use of this document is prohibited. This document (including any attachments) is intended only for the addressee, it may contain information of a privileged and confidential nature. If you are not the addressee of this communication, you must not copy, reproduce, disseminate or use this email and its contents. If this communication has been received in error by you, please inform us immediately and securely delete. Sharing, transmitting, copying, disseminating all or part of the contents of this document may result in a breach of the Federal Privacy Legislation and or copyright and trademark infringement of Brerona Capital Asset Management Pty Ltd and its related entities.